Out of Home global adspend hits $46.2bn in 2024 – WOO forecasts $49.8bn in 2025

Global OOH spend in 2024 reached $46.2bn representing 4.8% of global ADEX – breaking through the $45bn barrier and up $1bn on the predicted spend for 2024 – its best year to date. OOH spend is forecast to grow to $49.8bn in 2025 according to the World Out of Home Organization’s latest Global Expenditure Report.

The Report covers 85 unique territories representing 95% of global GDP and 79% of global population. Unreported territories are modelled from similar territories based on population and total GDP. The Report represents the most comprehensive survey of OOH expenditure globally.

Regionally APAC dominates with 49% of global OOH spend at $22.8bn against 40% of global GDP. North America reports $9.7bn, 22% of the total, which alongside Europe ($9.5bn), LATAM ($2.7bn) and Africa ($1.4bn) track behind their share of GDP – although expenditure in Africa may be under-reported.

Global digital OOH expenditure (DOOH) rose to $17.9bn USD in 2024 representing almost 39% of all OOH revenues and remains the main driver of OOH revenue growth globally.

Investment in DOOH infrastructure varies across the world with APAC and Europe ahead of the global average at 41.6% and 40.8% respectfully. North America at 34.4% , LATAM at 31.1% and Africa at 24.4% of total OOH revenues.

The continued room for growth in DOOH is exemplified by territories that have invested heavily in DOOH screens – of the top ten markets by overall OOH volume: Australia (74% of OOH revenue), UK (66%), China (46%), Brazil (46%) and South Korea (44%) lead the way in driving growth through DOOH.

Programmatically traded DOOH grew to a reported total spend of $1.7bn USD globally, representing 9.4% of total DOOH revenues. Programmatic is forecast to reach 10.9% of all DOOH revenues, totalling $2.2bn in 2025.

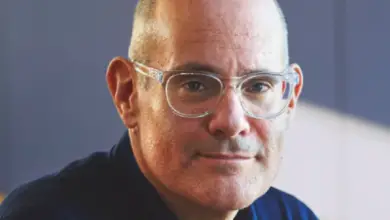

WOO President Tom Goddard says: “Accurate information is the bedrock of successful media and our Global Expenditure Report is the biggest and most accurate for the medium. It shows that OOH is still growing – even in a media world dominated by the internet – and we are increasing our share against other legacy media too.”